The Clean Energy Manufacturing Initiative (CEMI) is a few years old now, but its mission is ongoing: to rally talent from across the industry to design and deploy more efficient technologies and find less wasteful ways to meet consumer material demands.

Renewable energy is the future of the manufacturing industry and CEMI is just one of many institutions helping get there. So let's take a look at some of the ways we can put renewables to work manufacturing the many products we depend on.

More Efficient Raw Material Processing

Turning raw materials into usable products are some of the costliest and most energy-intensive activities within manufacturing.

In 2017, bulk chemical, refining and mining were the three most energy-intensive industries in the United States. Industrial entities use vast amounts of electricity to operate heavy equipment, run heating and cooling systems and keep offices and other facilities lit and climate-controlled. Some fuel sources such as natural gas, coal, petrochemicals and fuel oils actually pull double-duty as feedstock in the manufacture of plastics, chemicals and other products.

Manufacturing certain rubbers, for example, requires the raw material to be heated to 355 to 390 degrees Fahrenheit, which represents a significant budgetary and ecological burden. Powering this kind of operation with solar arrays and wind turbines is an increasingly attractive alternative over incumbent energy sources like coal-generated electricity.

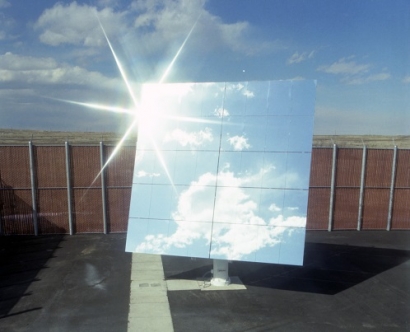

In fact, a soap company located in the suburbs of Chicago shows what's possible when multiple renewable energies converge to support the processing of raw chemicals. The headquarters of Method Soap boasts a wind turbine, a green roof and solar panels that track the sun throughout the day.

Cleaner and More Efficient Factories

Electric car maker Tesla appears on track to make good on their promise of powering their "Gigafactory" with 100 percent renewable energy by the end of 2019. This is a significant milestone for several reasons:

This achievement isn't just good for Tesla — it's good for the consumer too. As a result of harnessing solar, wind and geothermal technologies to power factories like this one, the company expects to slash the prices of some of their products by up to $3,000.

Tesla is far from the only company establishing a leadership position in renewable energy infrastructure. Procter & Gamble purchases 80 percent of the electricity generated by a wind farm in Cooke County, Texas. It's part of the company's plan to power all of its facilities in North America with 100 percent wind power.

As of March 2019, the Solar Energy Industries Association had identified more than 8,200 proposed large-scale solar projects, representing a total output of 107 Gigawatts.

Long-Term Energy Security

Geopolitical uncertainty makes it difficult to predict future oil prices with any kind of certainty. Nevertheless, some industry prognosticators are calling for higher crude oil prices in 2019. That means we can expect, at best, unpredictable energy prices and, at worst, higher prices for everybody who relies on incumbent energy sources to keep their operations moving.

One of the chief benefits of moving manufacturing and other industries to renewables is that they provide stability and security over the long term. Even if we see oil prices fall instead of rise in 2019, this is a temporary fix on top of a permanent problem: oil is a finite and environmentally destructive natural resource.

What this means is that it's likely "pennies wise" and "pounds foolish" for heavy industries like manufacturing to invest in fossil fuel-powered equipment and infrastructure today. A solar panel installed today atop an assembly plant or distribution center will likely still be producing electricity 30 years from now. By that time, fossil fuels will seem even more like dinosaurs than they do today and photovoltaic cells will be even more efficient, making a system upgrade an easy investment to justify.

Fossil fuels are, in comparison, increasingly difficult to justify from an investment perspective. And no matter the short-term price paroxysms we might observe in the coming months and years, the long view says we'll see dwindling returns if we cling to fossil fuels.

At the very least, the benefits of a diverse energy portfolio speak for themselves. Manufacturers can, and should, hedge their bets against rising fossil fuel prices — starting today. Solar, wind and hydroelectric are the heirs apparent to coal, oil and natural gas. Not to be outdone, even tidal power is coming into its own, albeit slowly.

In short, there's every reason for corporate decision-makers as well as consumers to get excited about this potential "wind"fall of cheaper, less harmful energy sources in the manufacturing sector.