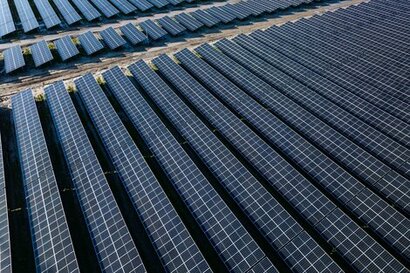

The facility will be drawn immediately to finance the Northwold Solar PV asset in Norfolk, with more assets to follow in 2024 and through 2025.

AMPYR Solar Europe is establishing itself as one of northwest Europe’s leading IPPs, enabling the company to continue its portfolio build-out across the UK, Germany, and the Netherlands.

“We are very pleased to have closed this framework financing facility by establishing a strong relationship with a leading project finance bank” said Tarun Agrawal, AMPYR Solar Europe’s CEO. “This facility will allow AMPYR Solar Europe to bring our Northwold Solar PV asset to market, and will help accelerate the construction and operation of 400MWp of solar assets in the UK over the near term.”

Northwold, with expected Commercial Operation Date (COD) during Q1 2025, will be AMPYR Solar Europe’s first UK solar PV asset to be built under this financing facility.

The project is underwritten by a Power Purchase Agreement (PPA), concluded in 2023 with Multiplex, a leading international contractor.

Further UK solar PV assets are planned to achieve COD in 2025 and beyond.

“Financing forward-thinking, distributed renewable energy projects like the Northwold Solar PV farm is a core part of NORD/LB’s mission” added Heiko Ludwig, Global Head of Structured Finance at NORD/LB. “Increasing the UK’s solar capacity at all levels is a crucial component of the national decarbonisation plan, and we are delighted to partner with AMPYR Solar Europe on an important regional project that will meaningfully contribute to those objectives.”

AMPYR Solar Europe continues to develop and construct a portfolio of solar assets across Germany, the Netherlands, and the UK. It now has a UK pipeline of close to 1GWp, and an aggregate European pipeline of 8GWp.

For additional information: