Back in 2007, a loose knit volunteer team of engineers, scientists, sales and marketing professionals, and entrepreneurs – nearly all of whom are silicon-valley start-up veterans – sat down to research new solar PV concepts. A year later, they incorporated the company StratoSolar and in October 2010, took out their first patent for a novel solar kite system they had developed.

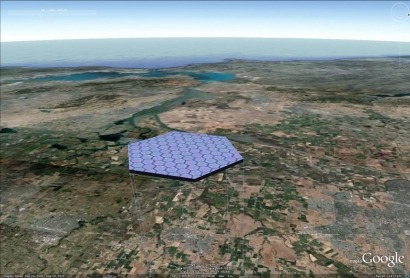

The StratoSolar PV kite comprises a PV array attached to a rigid buoyant platform and permanently positioned in the stratosphere at an altitude of between 10 and 20 km. It gathers sunlight, converts it to electricity and transmits it down a tether/high voltage (HV) cable to the ground where it connects to the electricity distribution grid.

A simple concept and one which the company is confident “represents an opportunity to make today’s PV technology cost effective without the massive subsidy needed to drive the technology to commercial viability in the 15 to 20 years historical trends indicate will be necessary”. StratoSolar also believes its concept is “an affordable alternative” for locations like the UK, Germany and Japan where PV is unlikely to ever be viable without subsidies.

But why and how? Renewable Energy Magazine caught up with StratoSolar’s President, Ed Kelly, to find out.

Subsidies or bust

Kelly highlights that the general view is that existing ground-based solar energy solutions are good enough or will be good enough someday soon to reach grid parity and this makes it unnecessary to explore risky alternatives. However, he warns that while this impression is common, the unfortunate reality is that solar energy has a long way to go to achieve market competitiveness.

“Even in economies that accept the reality of climate change there is a limited willingness to pay beyond market price for energy. The US which is generally sceptical on climate change still subsidises alternate energy solutions, though somewhat erratically. There would be little or no alternative energy business in the US or elsewhere without these subsidies. Today’s political and economic climate does not bode well for the future of these subsidies,” he warns.

Many industry projections, he explains, are for the current dismally low electricity market share of solar (<< 1%) to actually fall over the coming decade as subsidies decline. Nonetheless, the only reliable way to improve solar energy’s market share is to deliver competitive market priced electricity. However, Kelly underlines that many new PV-based alternatives promise the magical market competitive $1.00/Wp total capital cost, but none are remotely close to delivering. “This failure rightly creates scepticism for any new venture,” says Kelly, who is confident that his company’s new concept can break this trend.

Calmer skies overhead

By producing a weather-independent, utility-scale (from 10 Mw to 1 GW in modular increments) solution, StratoSolar aims to produce market competitive electricity without this need for subsidies.

The company’s idea exploits two environmental facts. Firstly, the stratosphere is a permanent inversion layer in the earth’s atmosphere. Inversion layers effectively isolate gas bodies. The calm weather free stratosphere is isolated from the turbulent troposphere below. There is no rain, hail, snow, or moisture in the stratosphere and wind force is much reduced and stable. This means that buoyant platforms suspended in the stratosphere can be permanently stationed there without needing to be winched down in bad weather. It also means that PV panels in the stratosphere do not suffer water based weather effects and can be simpler and cheaper to manufacture.

Secondly, light from the sun at 20km altitude is both strong and constant from dawn to dusk. At 20km a platform is above over 90% of the atmosphere, so sunlight is not significantly scattered or absorbed and there are no clouds to interrupt power generation. This means that on average PV panels produce multiples of the energy they can generate on the ground, and just as important, the energy is highly predictable and not subject to interruption by clouds or storms.

Similar outlay, greater returns

Equally as critical to StratoSolar’s potential success is that the StratoSolar kite generates electricity at a reasonable market competitive cost mostly because the solar PV array (which dominates PV cost) has a similar capital cost to current ground-based PV power plants but generates electricity with a higher utilisation, resulting in a lower market competitive cost of electricity.

No land has to be acquired or developed to install a StratoSolar PV system, the PV array support structure uses very little material due to light structural loads, while all materials are standard, off the shelf, and low cost. Furthermore, the PV panels are lower cost than ground-based PV panels due to reduced panel packaging cost.

On the flipside, the StratoSolar approach does incur additional capital costs that are not present in conventional PV arrays: the tether/HV cable, the winch, the gasbags and the hydrogen they contain. However, adding everything up the capital cost of a StratoSolar plant (in $/Wp) is the same as or lower than the same plant on the ground.

Three times the output

In general, Kelly and his team estimate, the PV panels on a StratoSolar kite are exposed to 1.5 to 3.5 times the solar energy (in kWh) of ground-based arrays, meaning that each square metre of panel gathers 1.5 to 3.5 times the energy of ground-based PV panels.

With this cost-output ratio, Ed Kelly is adamant that the StratoSolar story is “especially compelling” for northern Europe where solar radiation levels are low. “What StratoSolar offers to northern Europe is a completely new option for market competitive electric power that is politically secure and has a stable and declining cost. The technology can scale to eventually provide for all electricity needs. Each country can independently generate its own power,” he says.

Source: StratoSolar

The chart above graphically illustrates the concrete facts about the unsubsidized cost of electricity generated from PV. The only assumptions made in creating the chart are interest rates, loan duration, O&M costs, and plant utilization. What you need to know to use the chart are the utilization % for the plant geography, and the all in capital cost for a PV plant in $/Wp. These numbers are well understood. The utilization is pretty much fixed by geographic location. The chart allows you to make your own assessment of what you expect the capital cost in $/Wp to be. The 2010 cost is generally accepted as $3.50/Wp and the historical rate of improvement in $/Wp has forty year track record that is still holding up well and predicts $1.50Wp in ten to fifteen years if PV volume keeps growing at its historical exponential rate. This belies the optimistic forecasts of the imminent arrival of $1.00/Wp.

Kelly highlights that the top blue line represents the levelised cost of electricity (LCOE) for $/Wp for a country such as England. Because of its poor solar radiation levels, “a realistic assessment is that England will never produce affordable electricity from PV even if capital costs fall below $1.00Wp,” he explains. However, in contrast with the English line he says, “the StratoSolar line (which could be for a StratoSolar plant in England) shows the StratoSolar plant would already be making electricity cheaper than conventional power plants with today’s PV costs.”

Kelly is optimistic that his figures hold true, and believes that if his company succeeds in raising the capital needed, “a 10Mp PV system will be delivering electricity to the grid for revenue in about three years”.

According to Kelly, the year ahead will be spent doing the engineering R&D to develop and prototype the elements needed to build a commercial PV system and to plan and develop the construction of the first 10MWp system. His company may then move to further develop their CSP kite system… but that’s another story in itself.

For additional information: