Total corporate funding, including venture capital/private equity (VC) funding, public market, and debt financing, in 1H 2024 totaled $16.6 billion, 10% lower year-over-year (YoY) compared to the $18.5 billion raised in 1H 2023. The number of deals increased 9% YoY, with 87 deals in 1H 2024 compared to 80 during the same period last year.

"Financing activity in the solar sector remains restrained despite tailwinds from the Inflation Reduction Act and favorable global policies. High interest rates, an uncertain rate trajectory and timeline, increasing trade barriers, supply chain challenges, concerns about the U.S. presidential election's impact on the sector, and constantly evolving trade policies have created an unpredictable and uncertain climate. This has slowed down development, investments, and decision-making," said Raj Prabhu, CEO of Mercom Capital Group.

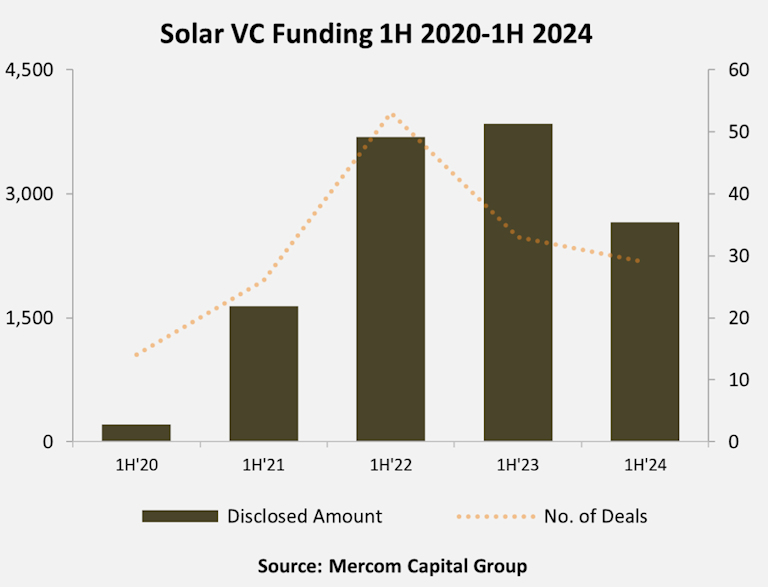

In 1H 2024, VC funding activity decreased 29% YoY, with $2.7 billion raised in 29 deals compared to $3.8 billion from 33 deals in the first half of 2023. However, in Q2 2024, global VC funding activity rose 29% year over year (YoY), with $2.2 billion in 16 deals compared to $1.7 billion raised in 15 deals in Q2 2023.

Solar downstream companies led financing activity with 24 deals worth $2.5 billion in 1H 2024.

The top VC deals in 1H 2024 were $650 million raised by Pine Gate Renewables, $520 million raised by Nexamp, $400 million raised by Doral Renewables, $325 million raised by MN8 Energy, and $200 million raised by ENVIRIA.

A total of 96 VC investors participated in solar funding in 1H 2024.

Solar public market financing in 1H 2024 totaled $1.7 billion in eight deals, 75% lower than $6.7 billion in 14 deals in 1H 2023.

Solar debt financing activity in 1H 2024 reached $12.2 billion in 50 deals, a 53% increase compared to 1H 2023 when $8 billion was raised in 33 deals. The first half of 2024 was the highest 1H total recorded in a decade for debt financing.

In 1H 2024, eight securitization deals totaled $2 billion, a 5% increase YoY compared to $1.9 billion raised in seven deals in 1H 2023.

In the first half of 2024, there were 40 solar M&A transactions, compared to 48 in the first half of 2023. The largest deal was by Brookfield Asset Management, an asset management firm along with institutional partners including Brookfield Renewable and Singapore's Temasek Holdings, which agreed to acquire a 53.12% stake in Neoen, a solar, wind, and energy storage project developer, for $6.54 billion.

In 1H 2024, 113 solar project acquisitions totaling 18.5 GW were transacted, compared to 116 project acquisitions totaling 25.5 GW in 1H 2023.

Project developers and independent power producers (IPPs) were the most active acquirers of solar projects in Q2 2024, accounting for 3.4 GW, followed by other companies (insurance providers, pension funds, energy trading companies, industrial conglomerates, and IT firms) with 1.6 GW. Utilities acquired a total of 1.3 GW, followed by 1.2 GW acquired by investment firms, and oil and gas companies acquired 250 MW.

This report covers 258 companies and investors. It is 96 pages long and contains 75 charts, graphs, and tables.